28+ mortgage interest and taxes

Over 90 million taxes filed with TaxAct. Web Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file.

28 Sheet Templates In Word

Use NerdWallet Reviews To Research Lenders.

. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Answer Simple Questions About Your Life And We Do The Rest. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Ad See what your estimated monthly payment would be with the VA Loan. Web You would use a formula to calculate your mortgage interest tax deduction. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Principal interest taxes and insurance. You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web Basic income information including amounts of your income. Web Direct home office expenses are fully deductible.

Web 2 days agoWhen it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Web When you file your tax return you must decide whether to take the standard deduction -- 12950 for single tax filers 25900 for joint filers or 19400 for heads of. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. The 28 rule isnt universal. File your taxes stress-free online with TaxAct.

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Web A taxpayer filing a US tax return can claim mortgage interest and property taxes as itemized deductions on their first or second home regardless of the country in. For taxpayers who use.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. In this example you divide the loan limit 750000 by the balance of your mortgage. Ad Learn More About Mortgage Preapproval.

Start basic federal filing for free. Browse Information at NerdWallet. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Web A mortgage calculator can help you determine how much interest you paid each month last year. For tax year 2022 those amounts are rising to. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web For married couples filing jointly the standard deduction is 27700 for 2023 up from 25900 in the 2022 tax year. You can claim a tax deduction for the interest on the first. This rule says you.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Thats an increase of 1800 or a 7 bump. Web The 3545 Model.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Ad Filing your taxes just became easier. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Homeowners who bought houses before. He paid 19100 in mortgage interest in 2022 as shown on his 1098 form.

Take Advantage And Lock In A Great Rate. Some financial experts recommend other percentage models like the 3545 model. Web Tax Implications of a Reverse Mortgage.

Use Form 1098 to report mortgage. Web Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe phrase is buy build or. Homeowners who are married but filing.

Indirect home office expenses are partially deductible in an amount equal to the percentage of your homes.

The Home Mortgage Interest Deduction Lendingtree

Cert Ambient Financing Generation Projects

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Buy To Let Mortgage Post Office Money

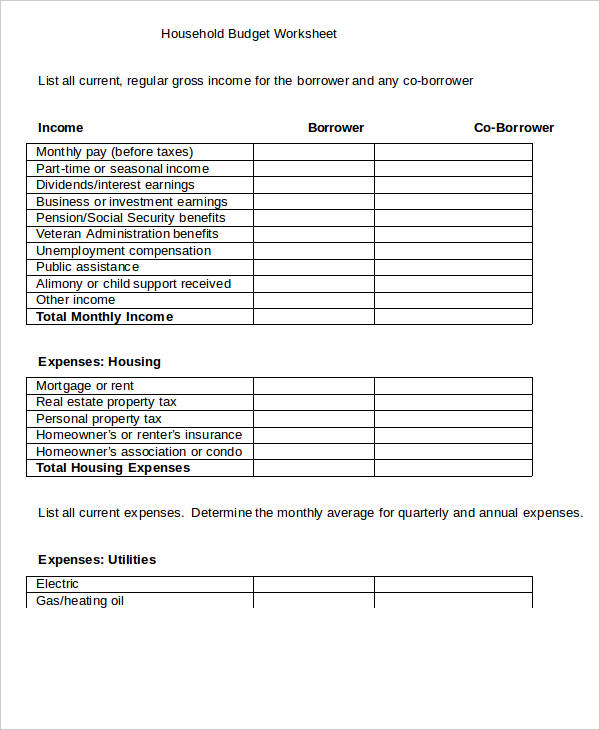

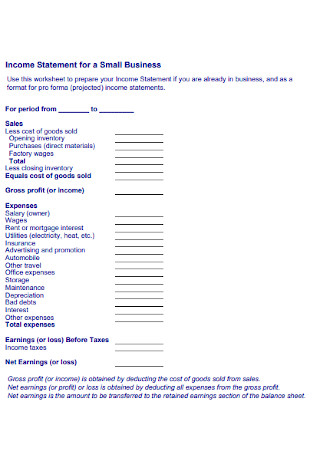

28 Sample Income And Expense Statements In Pdf Ms Word

Getting Started Post Office Money

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

21 East Rockville Court Newfoundland Pa 18445 Mls Pawn100284 Listing Information Long Foster

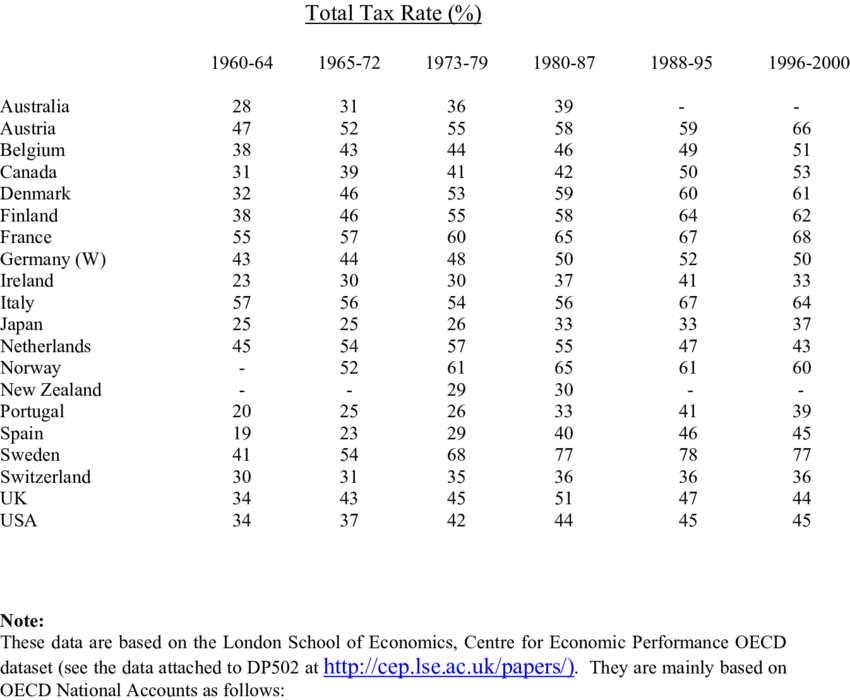

Countdown To 1 2011 Marks 20th Year That U S Corporate Tax Rate Is Higher Than Oecd Average Tax Foundation

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

Around Alhambra September 2022 By Around Alhambra Issuu

Tax Q A Mortgage Interest Deduction And Other Matters Wsj

Ex 99 1

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Home Mortgage Interest Deduction The Tax Break That Can Cost You Money Retirement Watch

Total Taxes On Labour Payroll Tax Rate Plus Income Tax Rate Plus Download Table